Welcome to the world of taxes, where numbers and deductions can make even the most organized individuals break out in a cold sweat. But fear not! We have an ally in our quest to conquer tax season: TaxSlayer. This user-friendly online tax preparation software promises to simplify the process and guide you through every step with ease. So grab your coffee, put on your thinking cap, and let’s dive into this smart guide on how to fill your taxes using Official-TaxSlayer. With TaxSlayer by your side, tax time may just become a breeze!

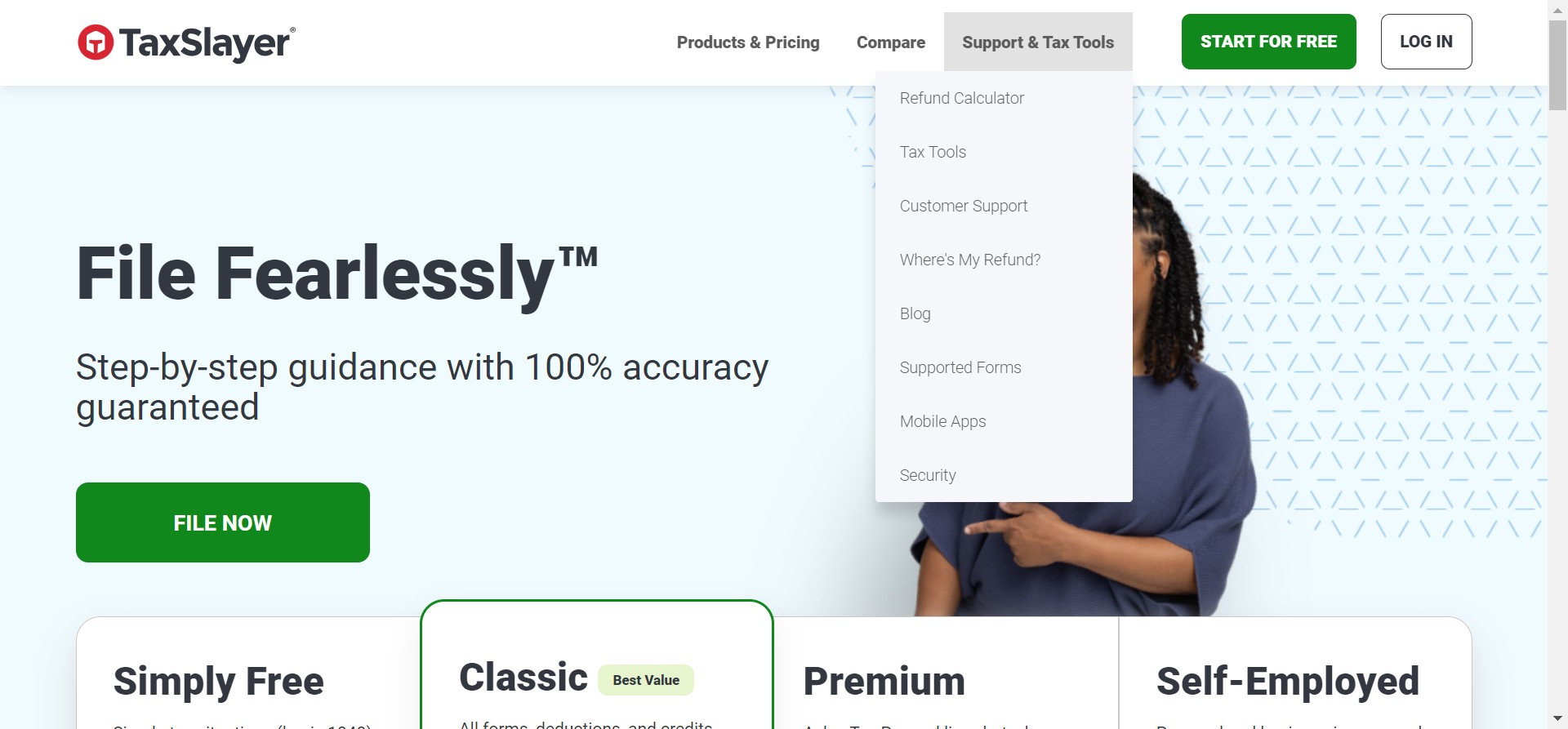

How to Use TaxSlayer

Using TaxSlayer to file your taxes is as easy as 1-2-3. First, you’ll need to create an account on their website by providing your basic information like name, email address, and password. Once that’s done, you can start the process of inputting your tax details.

TaxSlayer will guide you through a series of questions to gather all the necessary information for your return. These questions are designed in a simple and straightforward manner, making it easy for even first-time filers to understand.

As you progress through the software, you’ll be prompted to enter different types of income such as wages, self-employment earnings, or investment gains. Don’t worry if this sounds overwhelming – TaxSlayer provides helpful explanations along the way so that you know exactly what to include.

If you have any deductions or credits available to claim (and who doesn’t love those?), TaxSlayer will help identify them based on your answers throughout the filing process. This ensures that no potential tax savings slip through the cracks.

Once all your information has been entered accurately, TaxSlayer will automatically calculate your refund or amount owed based on current tax laws. You’ll also have the opportunity to review everything before submitting electronically.

In just a few steps with TaxSlayer’s user-friendly interface and clear instructions at every turn, preparing and filing your taxes becomes an achievable task rather than a daunting chore. So why not save yourself time and stress by harnessing the power of technology? Give TaxSlayer a try this tax season!

What to Expect When Filing Your Taxes with TaxSlayer

When it comes to filing your taxes, using a reliable and user-friendly software like TaxSlayer can make the process much smoother. But what exactly can you expect when using TaxSlayer? Let’s take a closer look.

First and foremost, TaxSlayer provides step-by-step guidance throughout the entire tax preparation process. Whether you’re a seasoned filer or new to the world of taxes, TaxSlayer will walk you through each section and ensure that nothing is missed.

One of the standout features of TaxSlayer is its ability to import information directly from previous year’s returns or even other tax software programs. This saves you time and reduces the chances of making errors when inputting data manually.

TaxSlayer also offers various options for how to file your taxes. You can choose between e-filing your return or printing it out and mailing it in if that’s what you prefer. Additionally, if you have questions along the way, their customer support team is available via phone or email to provide assistance.

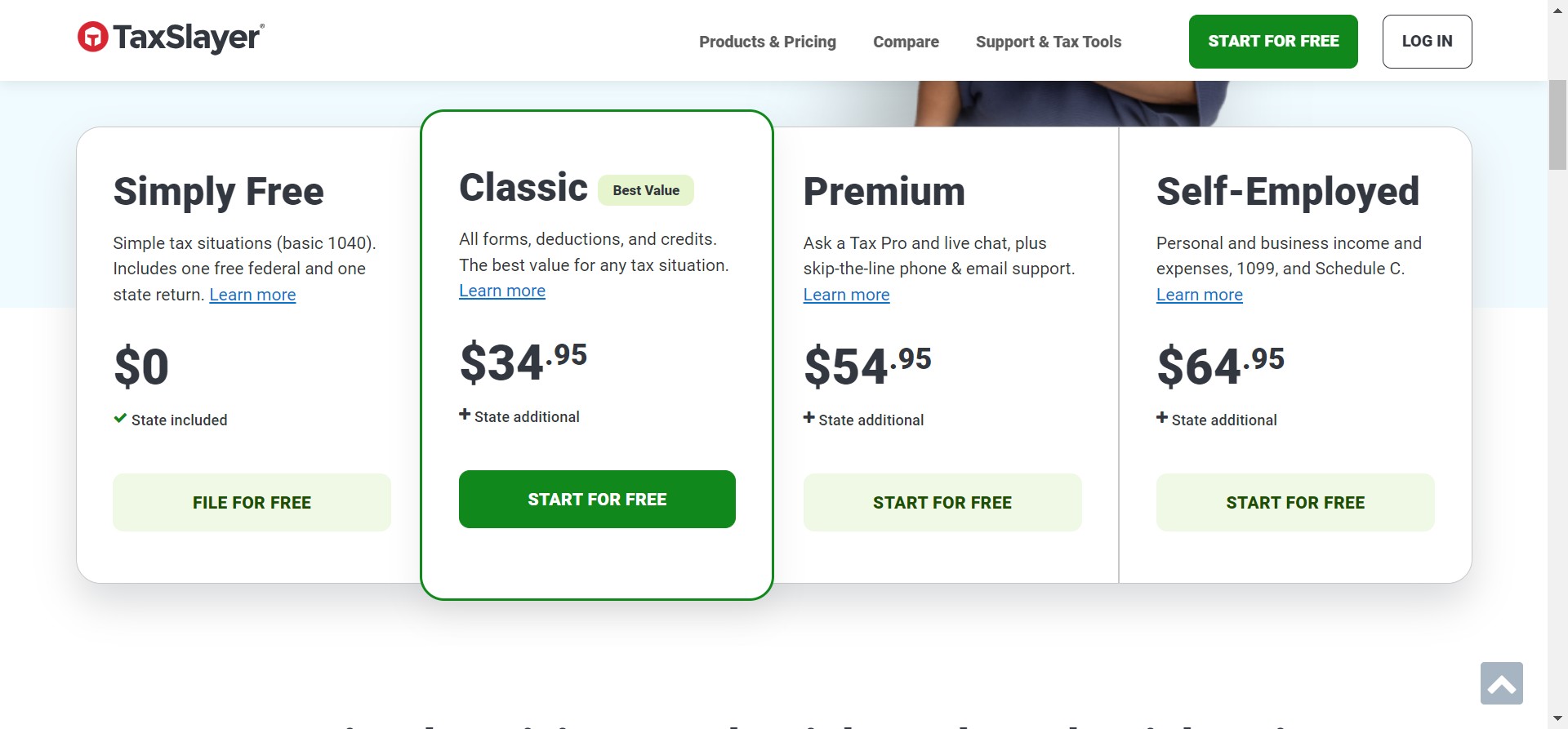

Another benefit of using TaxSlayer is its affordability. With different pricing tiers depending on your needs – including free options for basic returns – there’s something for everyone.

When filing your taxes with TaxSlayer, you can expect an intuitive interface, helpful guidance throughout the process, importing capabilities for convenience, multiple filing options, and affordable pricing. So why not give it a try this tax season?

Pros and Cons of Using TaxSlayer

One of the biggest advantages of using TaxSlayer is its user-friendly interface. Whether you are a tax expert or a beginner, navigating through the platform is straightforward and hassle-free. The intuitive design ensures that even complex tax forms can be completed with ease.

Another pro of TaxSlayer is its affordability. Compared to other tax preparation software on the market, TaxSlayer offers competitive pricing options that fit different budgets. With various packages available, you can choose one that suits your needs without breaking the bank.

TaxSlayer also provides excellent customer support to users. If you have any questions or encounter issues while filing your taxes, their knowledgeable and friendly support team is just a phone call away. They strive to assist you promptly and efficiently throughout the entire process.

Cons of Using TaxSlayer

While there are many positives to using Taxslayer, it’s important to consider some potential drawbacks as well. One possible con is that not all types of returns may be supported by this software. If your tax situation involves complicated investments or unique circumstances, it’s essential to ensure that TaxSlayer can handle them before committing.

Another potential drawback relates to state returns fees in certain cases where additional charges may apply for filing state taxes. This cost should be taken into account when considering whether or not to use this service.

In conclusion,

Despite these few cons, overall, TaxSlayer remains an excellent option for individuals looking for a reliable and affordable way to file their taxes online. Its user-friendly interface, competitive pricing options, and helpful customer support make it a popular choice among taxpayers across the country.

Alternatives to TaxSlayer

While TaxSlayer is a reliable and user-friendly option for filing your taxes, it’s always good to explore other alternatives. Here are some popular tax preparation software options that you can consider:

1. TurboTax: TurboTax is one of the most well-known tax preparation software in the market. It offers a wide range of features and intuitive navigation, making it suitable for both beginner and advanced users.

2. H&R Block: H&R Block provides comprehensive tax solutions with live assistance from certified tax professionals if needed. Their user interface is simple and easy to navigate, making it a great option for those who prefer personalized support.

3. TaxAct: TaxAct is known for its affordable pricing plans and robust feature set. They offer various packages tailored to different needs, including self-employed individuals, investors, and filers with complex tax situations.

4. Free File Alliance: If you’re looking for free tax filing options, the IRS partners with several companies through the Free File Alliance program. These companies provide free online software for eligible taxpayers based on income thresholds.

Remember that each alternative has its own strengths and weaknesses, so choose the one that aligns best with your specific needs and preferences.

In conclusion,

Filing taxes may seem like an overwhelming task at first glance but using reputable tax preparation software like TaxSlayer can simplify the process significantly. With its user-friendly interface, thorough guidance throughout each step, and affordable pricing plans; you can confidently file your taxes accurately without breaking a sweat!

However, it’s essential to weigh your options carefully before settling on any particular platform as everyone’s financial situation differs greatly.

So take some time to explore multiple alternatives like TurboTax, H&R Block,TaxAct or even avail yourself of free filing options offered by IRS through their Free File Alliance program based on eligibility criteria.

You deserve peace of mind knowing that you’ve made an informed decision when choosing how to file your taxes.

Remember, tax season doesn’t have to be stressful. With